Group-IB, a leading creator of cybersecurity technologies to investigate, prevent, and fight digital crime, announced today its contributions to INTERPOL’s “Operation Contender 3.0”. Leveraging investigative intelligence provided by Group-IB, law enforcement agencies across 14 countries arrested 260 suspects and seized 1,235 electronic devices connected to 81 cybercriminal infrastructures involved in romance scams and sextortion schemes, which collectively caused nearly US$2.8 million in financial losses from 1,463 identified victims.

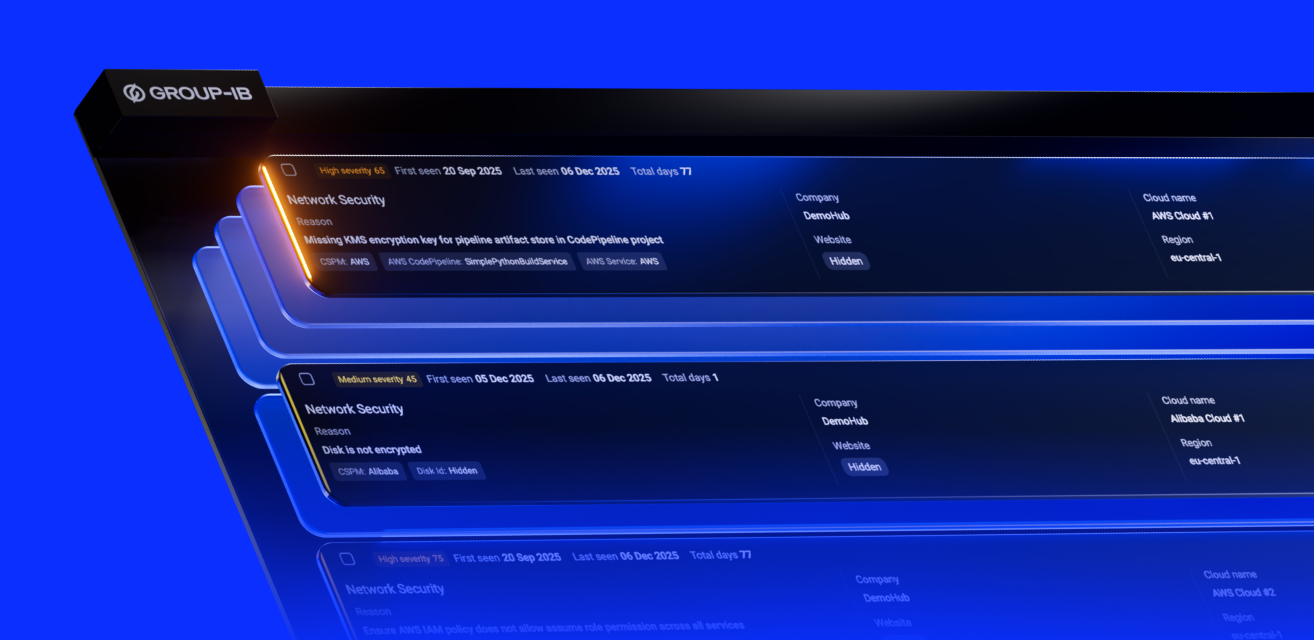

Suspects detained by law enforcement authorities in Ghana, and the devices used in the romance and sextortion scams seized in Angola. Image credit: INTERPOL.

As an INTERPOL Gateway Partner, Group-IB provided intelligence on the perpetrators that targeted and interacted with victims of romance scams and digital sextortion. Group-IB’s High-Tech Crime Investigations team also detected and shared further details regarding the payment data used by these criminals in their extortion attempts, enabling investigators to trace financial flows and improve attribution. These prominent threats were also highlighted by Group-IB in the recent INTERPOL Africa Cyberthreat Assessment Report.

“Cybercrime units across Africa are reporting a sharp rise in digital-enabled crimes such as sextortion and romance scams. The growth of online platforms has opened new opportunities for criminal networks to exploit victims, causing both financial loss and psychological harm. By working closely with our member countries and private sector partners, we remain committed to disrupting and dismantling the groups that prey on vulnerable individuals online.”

Acting Executive Director of Police Services at INTERPOL

“Cybercriminals behind romance scams and sextortion deliberately exploit some of the deepest human vulnerabilities, such as trust and emotional attachment. They manipulate victims by taking advantage of their feelings and personal relationships, turning genuine emotions into tools of deception and coercion. We are grateful to INTERPOL and all participating authorities for their swift response and tireless efforts for this operation. Through our ongoing partnership with INTERPOL, Group-IB remains committed to dismantling these networks and protecting individuals from both financial devastation and profound psychological harm.”

CEO of Group-IB

In Ghana, authorities detained 68 suspects and seized 835 electronic devices, uncovering 108 victims linked to the scams. Investigations revealed financial losses totaling US$450,000, of which US$70,000 was successfully recovered. The romance scam operations relied on fraudulent profiles, forged identities, and stolen images to deceive victims, extracting payments through various ruses such as fake courier services and customs fees. In cases of sextortion, perpetrators secretly recorded explicit video chats and later used the footage to extort money from their victims.

In Senegal, police arrested 22 individuals involved in a scheme where criminals posed as celebrities to manipulate victims on social media and dating platforms. The network defrauded 120 victims, causing losses of approximately US$34,000. During the operation, authorities seized 65 electronic devices, along with forged identification documents and money transfer records linked to the scams.

In Angola, authorities arrested eight suspects and identified 28 victims, both domestic and international, who were primarily targeted through social media platforms. The perpetrators relied on fraudulent documents to forge identities, enabling them to carry out financial transactions and conceal their true identities while deceiving and exploiting victims.

“Operation Contender 3.0” is a follow-up of “Operation Contender 2.0”, that led to two arrests in Nigeria on 27 April 2024 for a romance scam that defrauded a victim in Finland, and six arrests in Côte d’Ivoire connected to a large-scale phishing scheme that caused over US$1.4 million in losses to Swiss citizens. The phishing scam involved QR codes on small ad websites to direct victims to fake payment portals, along with phone impersonation of customer service agents. Between August 2023 and April 2024, Swiss authorities received more than 240 reports of the fraud, which helped investigators trace the network to Côte d’Ivoire.