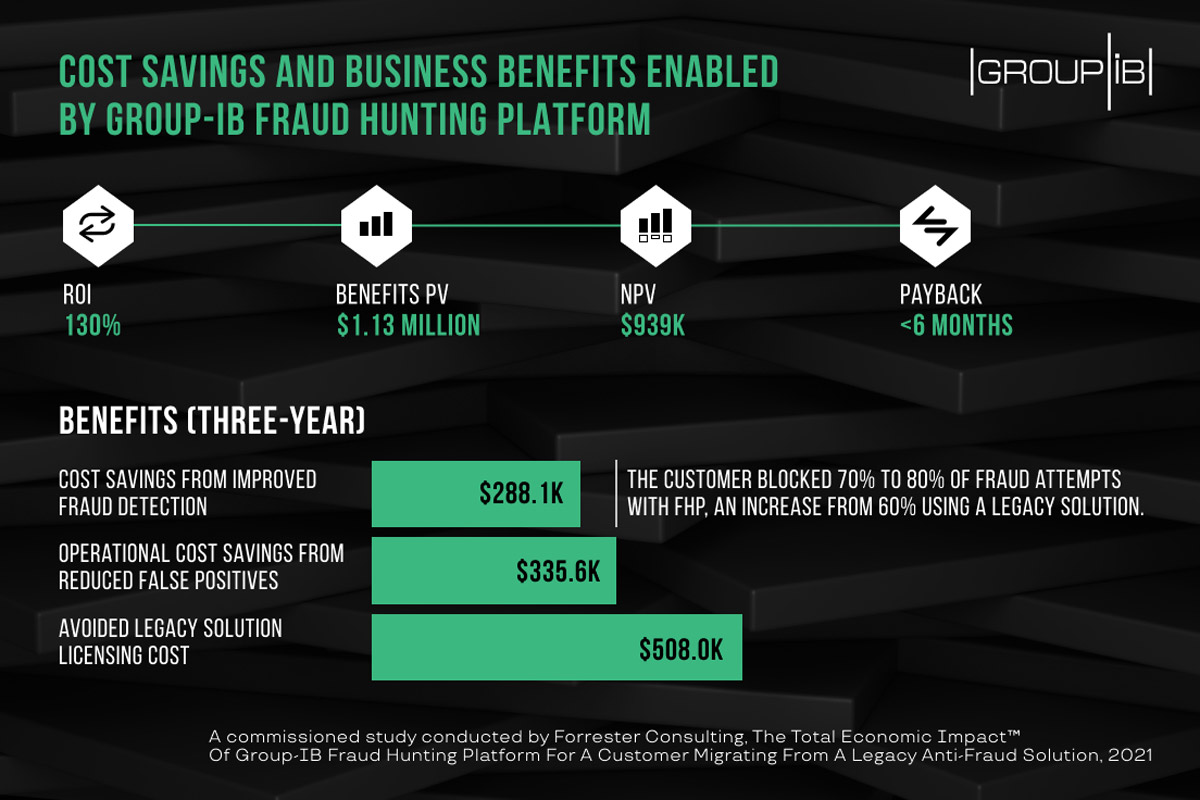

Group-IB, one of the leading providers of solutions dedicated to detecting and preventing cyberattacks, identifying online fraud, investigation of high-tech crimes and intellectual property protection, has today revealed a new independent commissioned study on the financial impact of Group-IB Fraud Protection conducted by Forrester Consulting. FHP performs real-time session and user behavior data analysis on web and mobile channels to help organizations accurately detect and efficiently prevent fraud. Forrester consultants analyzed the improvement in performance in a bank transitioning from a well-established solution to the Fraud Hunting Platform. This bank, which serves 10 million customers and over 6 million transactions a day, experienced a three-year 130% ROI with payback in less than 6 months after adding Fraud Hunting Platform (FHP) to its anti-fraud stack. The study identified that Group-IB FHP generated significant operational cost savings by reducing false positives by 20%.

According to the Forrester study, business leaders turn to enterprise fraud management against the backdrop of more robust regulatory requirements to reduce fraud and rising customer expectations for a smooth digital experience. False-positive is one of the major issues faced by companies that process millions of transactions. The high number of false positives resulted in extra costs for businesses and unhappy customers.

The Forrester consultants interviewed a bank with experience using Fraud Hunting Platform. Prior to FHP, the organization tackled fraudulent activities using a legacy anti-fraud solution which generated a high number of false positives. The investment in Group-IB’s FHP helped the bank to reduce the false positives by 20%. Group-IB’s solution required 30% fewer OTP (SMS) for 2FA purposes, improving the bank’s customer digital experience and enabling the bank’s fraud analysts and call centers to focus on truly risky transactions. FHP enabled the organization to protect their web and mobile channel with a higher degree of confidence as well as to detect and prevent fraud more accurately and efficiently, which generated $228K in cost savings. Altogether, Forrester’s interview and financial analysis found that the organization experienced a net present value of $639K and an ROI of 130% over three years.

Another unquantified advantage outlined by Forrester study is the improved customer experience in the organization that switched from a legacy anti-fraud system to FHP. Group-IB’s solution ensured security without unnecessary customer friction and helped build customer trust by minimizing fraud cases. It can also leverage the data collected to support anti-money laundering investigations and customer onboarding processes.

Preventing fraud does not stop at detection, but at prosecution, your fraud solution must give you the means to compile a case for the authorities. Fraudsters are bullies, and if you bite back, they will avoid you.

Product Marketing Manager (FHP) at Group-IB

Download the study «The Total Economic Impact™ Of Group-IB Fraud Hunting Platform For A Customer Migrating From A Legacy Anti-Fraud Solution», June 2021.