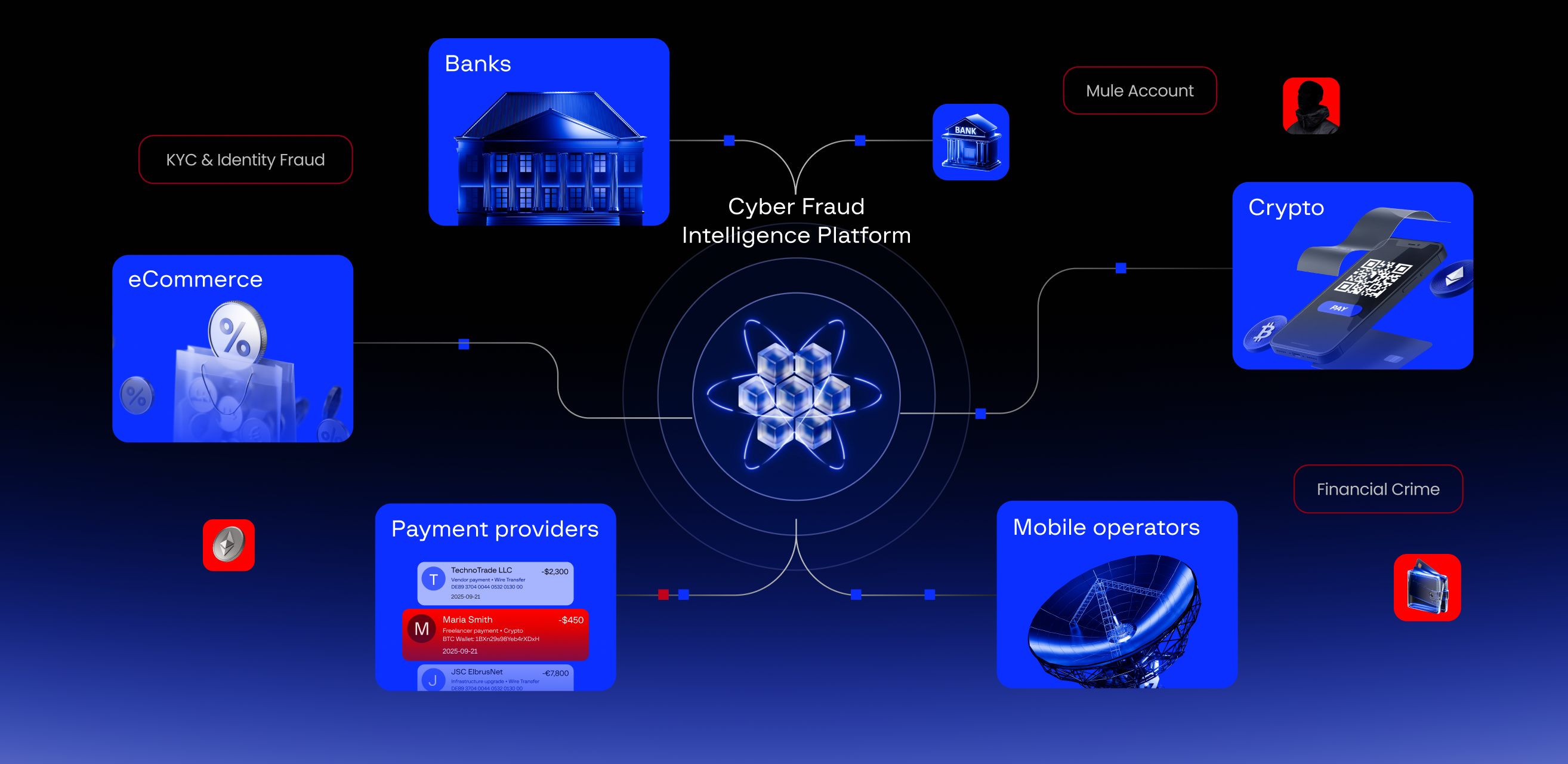

Group-IB, a leading creator of cybersecurity technologies to investigate, prevent, and fight digital crime, today announced the launch of the Cyber Fraud Intelligence Platform (CFIP) – a real-time, privacy-preserving collaborative solution that enables banks and organizations across financial services, payments, telecommunications, e-commerce, gaming – and any organization facing digital fraud, to detect and prevent threats together without exposing personal data.

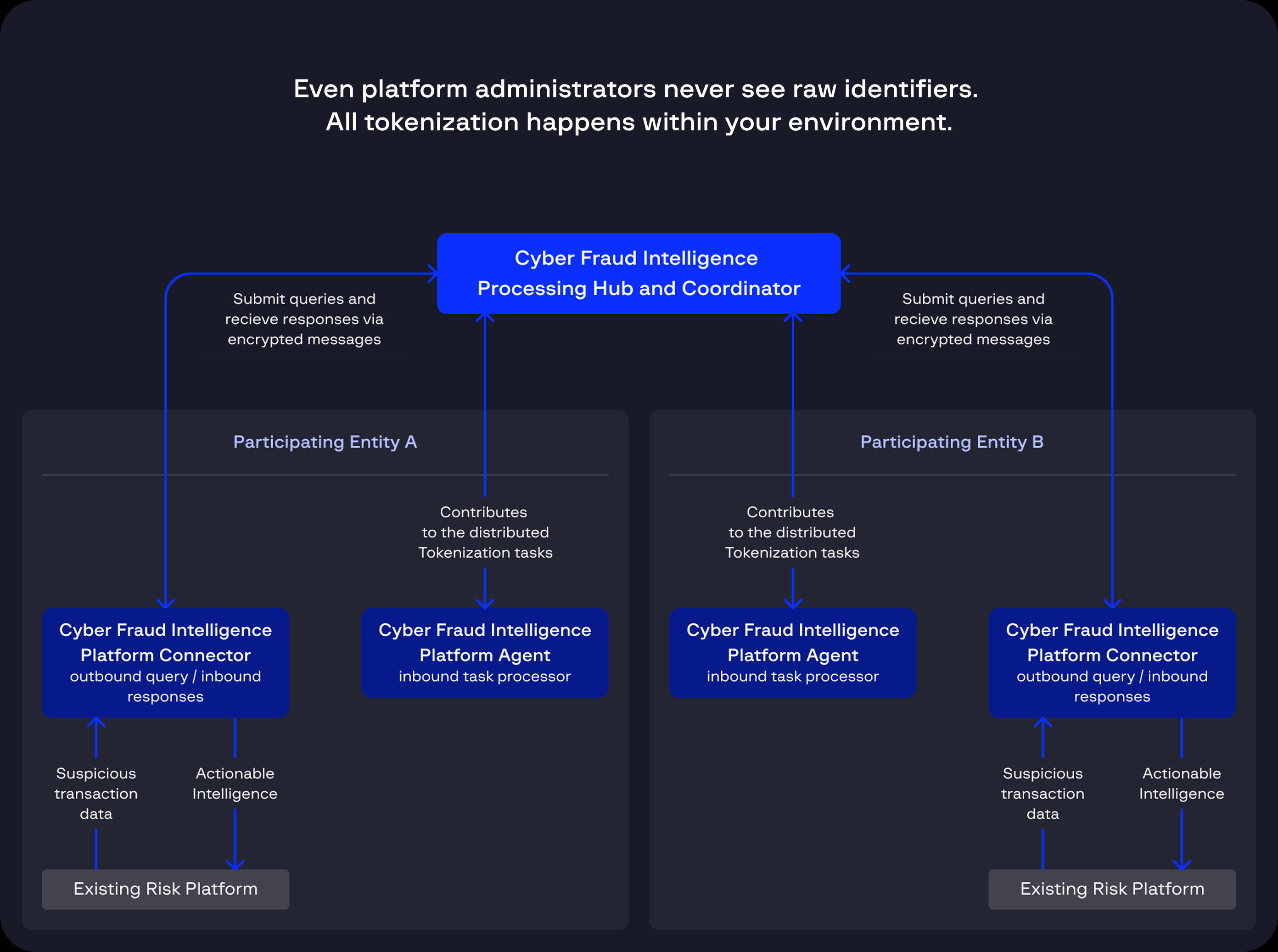

Completely system-agnostic, CFIP integrates seamlessly with existing fraud and risk management systems. Powered by Group-IB’s patented Distributed Tokenization technology, independently validated by Bureau Veritas as fully GDPR-compliant, CFIP lets institutions securely exchange anonymized “risk signals” to uncover coordinated fraud patterns that would otherwise remain invisible.

By correlating these signals in real time, CFIP helps stop emerging scams – such as authorised push payment (APP), investment, and romance scams; business email compromise (BEC); mule-account networks; synthetic identities; and account takeovers – preventing fraudulent transfers before funds are lost.

The Cyber Fraud Intelligence Platform Microservices enables privacy-preserving real-time information sharing between institutions

Privacy and instant reactive detection – solving an industry-wide problem

At the core of CFIP is Group-IB’s patented Distributed Tokenization technology, which enables participating organizations to collaborate in real time on suspicious activity – not just confirmed fraud. Traditional fraud sharing is reactive; by the time fraud is confirmed, the money is already gone. CFIP allows organizations to securely compare signals on suspicious payments and accounts before a transaction is completed, stopping APP fraud and mule activity, for example, before funds ever leave the bank.

All customer information remains fully anonymized and protected, ensuring personal data never leaves the organization.

CFIP’s privacy architecture has been independently verified by Bureau Veritas, confirming that its design and processing methods are fully GDPR-compliant. The certificate makes CFIP the first global, real-time fraud intelligence platform to achieve this level of validation.

“CFIP bridges one of the biggest gaps in financial-crime prevention – the ability to collaborate securely. By combining real-time risk-signal sharing with independently verified privacy safeguards, CFIP allows the industry to work together to stop fraud before it happens.”

Financial Crime and Compliance Specialist at Group-IB

“Financial crime is one of the most complex and costly challenges of our time, and no single organization can solve it alone. CFIP reflects our commitment to tackling digital crime through collaboration – proving that when privacy, compliance, and shared intelligence come together, the entire financial ecosystem becomes stronger and more resilient.”

CEO of Group-IB.

From isolated suspicions to collective defense

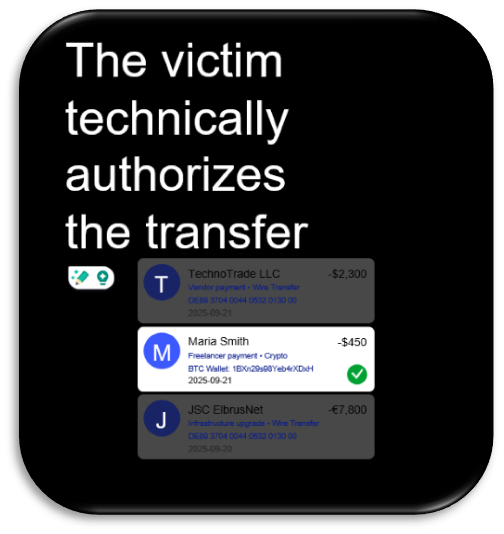

Traditional fraud detection tools often react only after the damage is done, making it difficult to keep pace with modern scams – such as “Hi Mum” and authorized push payment fraud (APP) – where victims are tricked into sending money themselves. Fraudsters can often move funds across multiple banks and jurisdictions within minutes, making recovery nearly impossible. CFIP enables banks to exchange in real time data on suspicious activity to help them make a decision to prevent fraud. The platform exchanges anonymized indicators in milliseconds, preventing fraudulent transfers before funds are lost.

Example of an authorized push payment

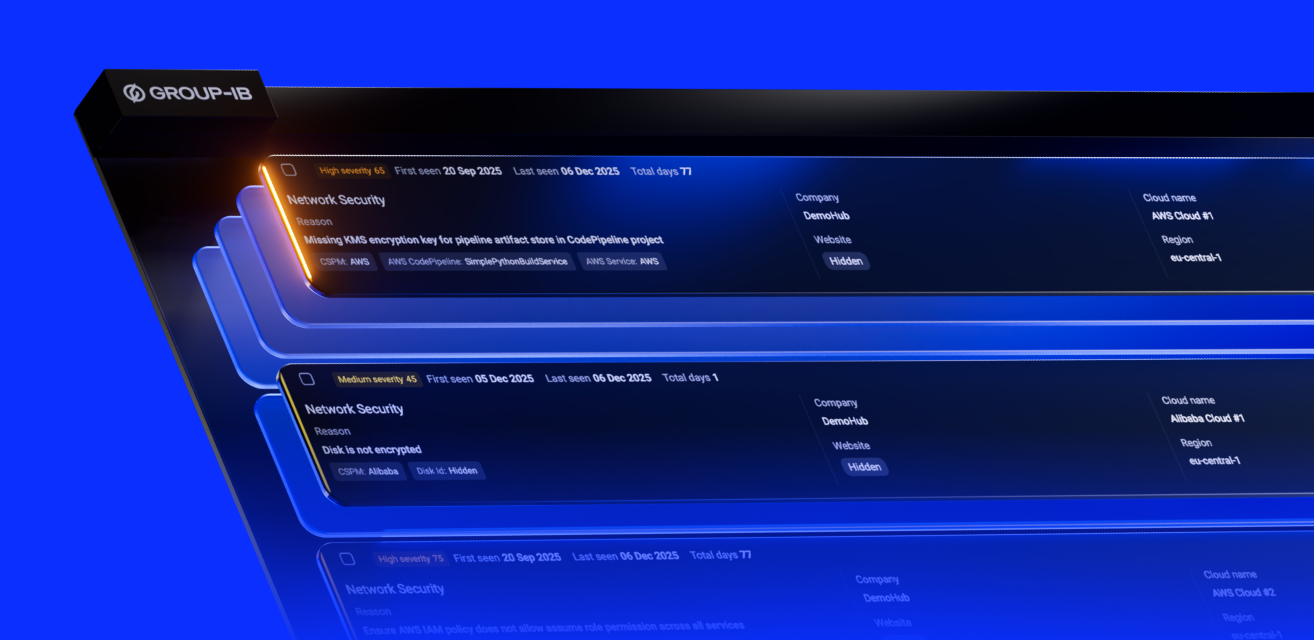

Scalable, secure, and cloud-optimized

Built and optimized on AWS cloud infrastructure as an official AWS ISV Accelerate Partner, CFIP integrates seamlessly with existing case-management and risk systems, enabling deployment in weeks rather than months.

Its microservice architecture supports global scalability and interoperability, with proven performance handling over 25 million transactions per day in national deployments. For institutions requiring on-premise or hybrid environments, CFIP offers flexible deployment options to meet data sovereignty and regulatory needs.

Turning regulation into action

Regulators worldwide are mandating greater fraud intelligence sharing – but without defining how to do it securely, in real-time, and at scale.

Frameworks such as the UK Payment Systems Regulator’s Specific Direction 20, and the EU AMLR (Article 75), Singapore’s COSMIC, and Australia’s Scam-Safe Accord all push for collaboration, while FATF guidance removes barriers to private-to-private data exchange, and the US Department of Treasury pushes efforts to enhance the operational effectiveness of the anti-money laundering/countering the financing of terrorism (AML/CFT) regime.

CFIP delivers the compliant, privacy-first “how”, turning regulatory obligation into operational prevention.

It also supports emerging resilience standards such as the EU Digital Operational Resilience Act (DORA), helping institutions demonstrate proactive compliance and consumer protection through verifiable, real-time intelligence sharing.

Use cases and measurable impact

In a Central Asian national deployment, CFIP already identifies 300–400 mule accounts daily and processes 180,000 checks, projecting $100–300 million in annual savings at full adoption.

CFIP closes blind spots that fraudsters exploit across siloed institutions, delivering network-level intelligence in real time. Key use cases include:

- APP Fraud Prevention – Real-time risk scores on recipient accounts stop scams before funds leave the payer’s bank.

- Account Takeover Detection – Correlates pseudonymized device and session data to flag the same criminal controlling multiple compromised accounts.

- Early Mule Detection – Identifies “warm-up” patterns in low-value transactions that single-bank systems miss.

- KYC & Synthetic Identity Fraud – Instantly reveals webs of fake identities using shared phone numbers, addresses, or documents.

- Loan Application Bust-Outs – Detects coordinated applications across lenders in milliseconds.

- Track & Trace – Enables secure, cross-bank fund tracing to freeze and recover stolen assets.

A call for collaboration

CFIP is designed to drive the cross-industry collaboration that regulators and banks have long called for. It enables financial institutions, regulators, and industry bodies to work together securely, turning isolated efforts into collective prevention. Group-IB’s fraud protection technologies have gained industry recognition for its innovation and measurable impact, including winning the “Anti-Fraud Project of the Year” at the Regulation Asia Awards for Excellence in 2023.