Introduction

In the fast-paced and ever-evolving world of iGaming, operating globally presents immense opportunities and unique challenges. One of the most significant challenges is navigating the complex landscape of varying regulations and risk profiles across different jurisdictions. Traditionally, this has meant sacrificing efficiency by managing multiple instances of anti-fraud solutions or stifling growth by applying a one-size-fits-all approach to risk management.

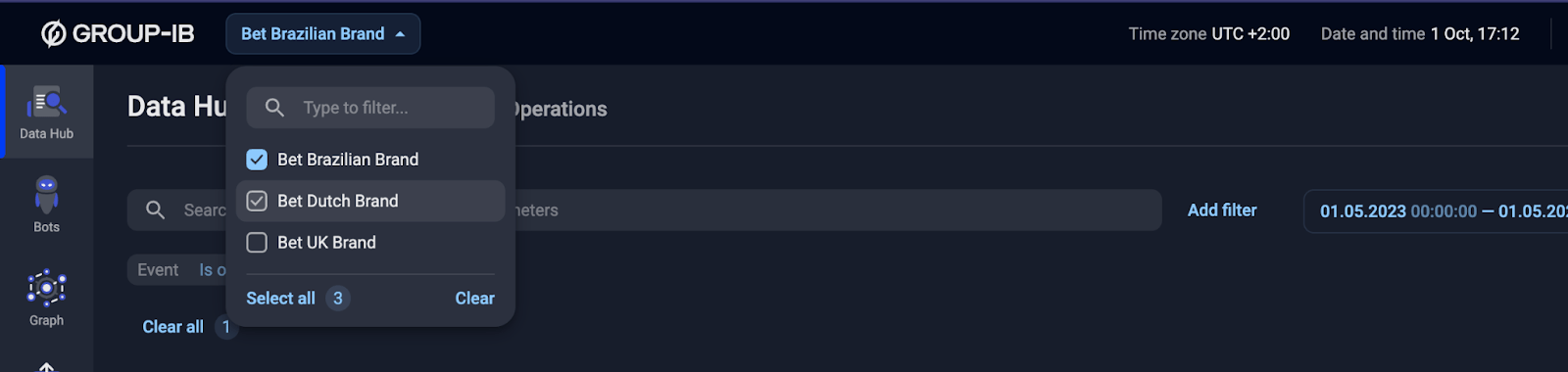

Group-IB Fraud Protection is a game-changing solution that empowers iGaming operators to manage multiple brands and jurisdictions, each with their tailored risk policies, all within a single, unified platform.

Image source: Manage your global business with Group-IB Fraud Protection

The power of flexibility

Group-IB’s innovative approach fundamentally changes the game for global iGaming operators. It allows them to:

- Embrace Regulatory Diversity: Different markets have different rules. With Group-IB, operators can configure risk policies to match the specific requirements of each jurisdiction precisely, ensuring full compliance without overstepping boundaries.

- Optimize Cost Efficiency: A centralized platform streamlines operations, reduces overhead, and allows for a leaner, more agile risk management team. There is no more juggling multiple systems or duplicating efforts.

- Maximize Growth Potential: By tailoring risk strategies to each market, operators can unlock new opportunities and expand their reach without friction. They can confidently enter new territories, knowing they have the tools to manage risk effectively.

- Avoid Unnecessary Friction: A one-size-fits-all approach to risk management can lead to missed opportunities and frustrated players. With Group-IB, operators can strike the perfect balance, applying just the right level of scrutiny to each market.

- Rapidly Adapt to New Markets: As new markets open up, such as the recent developments in Brazil, operators need to be able to move quickly. Group-IB’s flexible platform allows for rapid configuration of risk policies, enabling operators to seize new opportunities without delay.

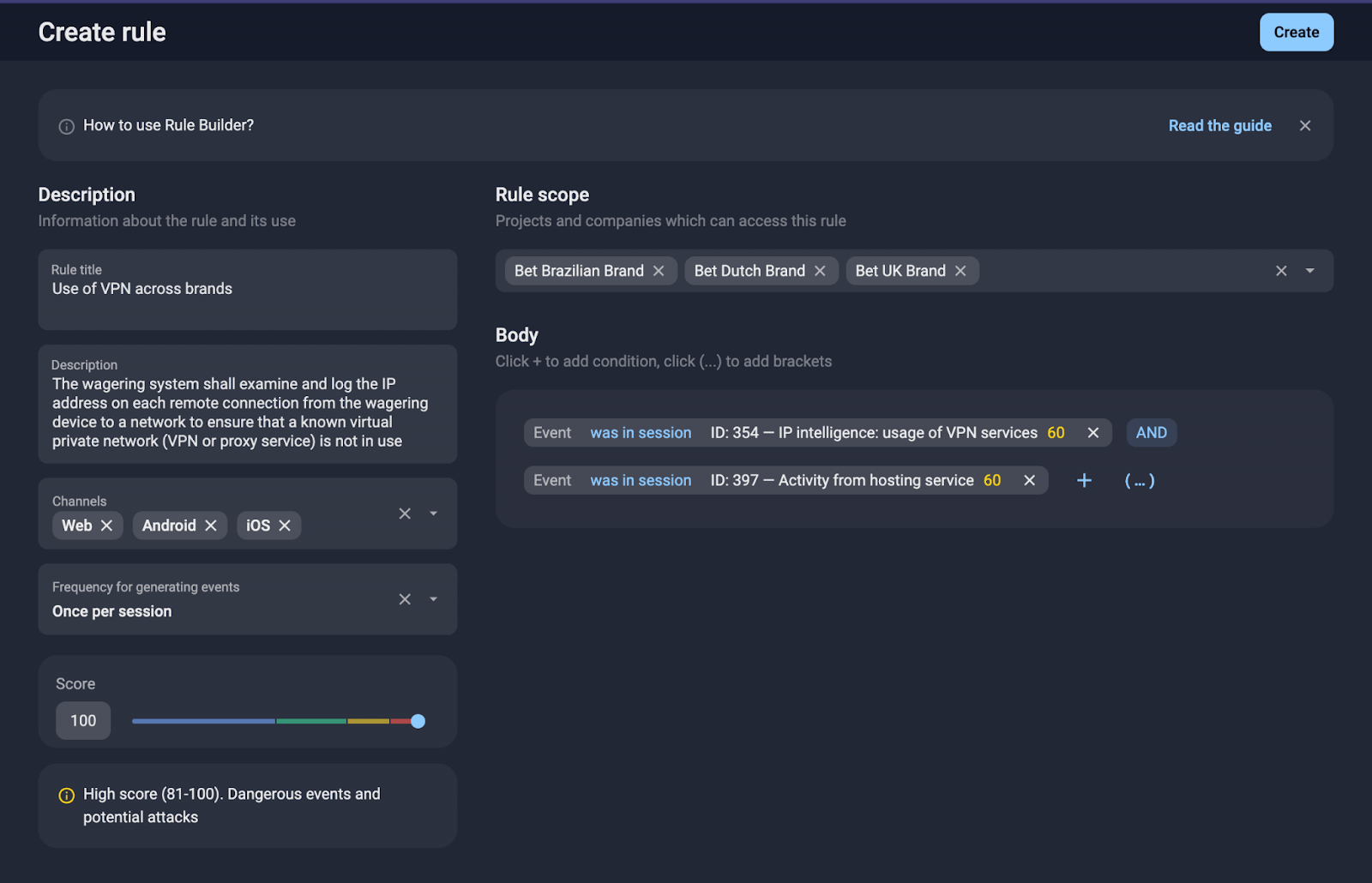

The Fraud Protection, no-code rule builder, allows users to easily create and test new Fraud Detection rules against historical data before implementing them.

Image source: Group-IB Fraud Protection rule builder

Fraud Detection and Prevention: Group-IB’s advanced machine learning algorithms and behavioral analytics can identify and block various types of fraud, including bonus abuse, multi-accounting, affiliation, and payment fraud. This helps protect both operators and players, ensuring a fair and secure gambling environment.

In the competitive world of iGaming, agility and adaptability are crucial. Group-IB Fraud Protection provides the flexibility and control that global operators need to thrive in a complex regulatory landscape. It’s the ultimate solution for those who understand that being a global player doesn’t mean playing by the same rules everywhere.

Group-IB Fraud Protection is a powerful tool that enables iGaming operators to navigate the complexities of the global market confidently. It offers the best of both worlds: the cost optimization benefits of a centralized platform and the flexibility to tailor risk strategies to each jurisdiction. With Group-IB, operators can truly play the game their way, no matter where they operate or how quickly the market evolves.

Why choose Group-IB as a cyber-fraud protection partner for your iGaming business?

- Regulatory Compliance: Navigate regulations confidently. Manage multiple brands and projects seamlessly with risk models tailored to each jurisdiction.

- Local Support: No surprise consulting fees! Our Regional Fraud Analysts are in Brazil, providing expert support as you scale.

- Marketing ROI Amplified: Acquisition in a country of 220 million can be expensive. Don’t waste money on unnecessary paying for every login or API call. Pay only for returning customers, and let your audience enjoy unlimited devices without impacting your budget.

- Empower Your Team: Our intuitive, no-code rule builder allows your team to fine-tune risk models effortlessly. You’re in control!

- Maximum Efficiency, Always: Our fraud analyst support is built into our service, so your team can maintain peak performance without worrying about extra costs

Key features of Group-IB Fraud Protection

- Advanced Device Fingerprinting: This technology creates a unique profile of each device accessing the online gambling platform, considering hardware, software, and behavioral attributes. This enables accurate identification and tracking of devices, even if users attempt to mask their identity.

- Cross-Channel Correlation: This technology links user activities across different platforms (web, mobile) to create a comprehensive view of user behavior. It helps detect fraudsters who attempt to exploit vulnerabilities across multiple channels.

- Global ID: This feature assigns a unique ID to each user, enabling tracking of their activity across multiple devices and platforms, even if they try to hide their identity. This helps prevent fraudsters from creating multiple accounts or using stolen credentials.

- Bot Protection: Group-IB’s patented Preventive Proxy technology analyzes user sessions to detect and block malicious bot activity, preventing automated attacks such as account takeover and credential stuffing.

- Behavioral Biometrics: This technology analyzes user behavior patterns, such as mouse movements, keystrokes, and touch gestures, to create unique behavioral profiles. It helps identify anomalies and detect impersonation attempts or account takeover.

- Geoprofiling and Geofencing: These technologies analyze the geographical location data associated with user activities to identify anomalies and suspicious patterns, detect unusual login attempts from unexpected locations, and enable operators to define virtual boundaries around specific areas, restricting access or triggering alerts for high-risk regions. This helps prevent account takeovers and fraudulent transactions and ensures compliance with location-based restrictions.

- Group-IB’s Threat Intelligence Integration provides real-time intelligence on cyber threats to Fraud Protection. This enables proactive identification and prevention of fraud attempts. The integration leverages Dark Web Monitoring, Telegram Group Monitoring, and Malware Analytics to identify and block fraud attempts targeting the online gambling industry.

‘Game on’ with Group-IB Fraud Protection

Connect with our experts to understand the unique risks to your iGaming business. Our complete suite of solutions and services can help you build and upgrade your risk management strategy and foolproof your defenses.